I’m going to go out on a small limb here and criticize one of the big boys in the financial blogging world. And I’m going to venture into politics, which I refuse to get into on this blog and will do so sparingly, if at all. Look, I realize I’m an amateur at finance. One of the reasons for creating the blog was to chronicle my venture into finance. But, Barry is wrong with his glee.

I can sum it up thusly: Whereas the Democrats have no economic policy, the Republicans have a very bad one.

The details are what makes Stockman’s take so astonishing. Here are his most important observations, of which I find little to disagree with:

I’ve pretty much stopped reading Barry’s blog because it’s become all about him. He pretty much knows it all and it’s all the republicans fault. But he’s wrong on this part. Barry knows a lot about finance. He’s showing some ignorance about politics though.

Yes the piece he is quoting from is a hit job by David Stockman, but he notes that he pretty much agrees with David Stockman on his points.

I’m sure Barry knows this but spending and tax policy is created by Congress.

Let’s go over that again. Budgets and spending are created and controlled by Congress.

The house was controlled by Democrats for more than 40 years before the Republicans came to power in 1994. Other than 1981 thru 1986, the Democrats controlled the Senate.

Other than those early years in the 1980’s, Congress was controlled by Democrats. All that spending and any tax cuts were done with the approval of Democrats. It’s a lie to say or imply that Republicans did this all by themselves. They didn’t. They couldn’t because they didn’t control Congress.

And I note, when the republicans did control congress starting in 1994, we ended up with a surplus.

I am not defending Bush. He was, from a fiscal standpoint, a bad president. However, he’s not even close to how horrible the current president is. Of course regardless of the president, spending is controlled by Congress. And the republican controlled Congress did a crappy job. And they were rewarded for their crappyness with being voted out of office, which they deserved.

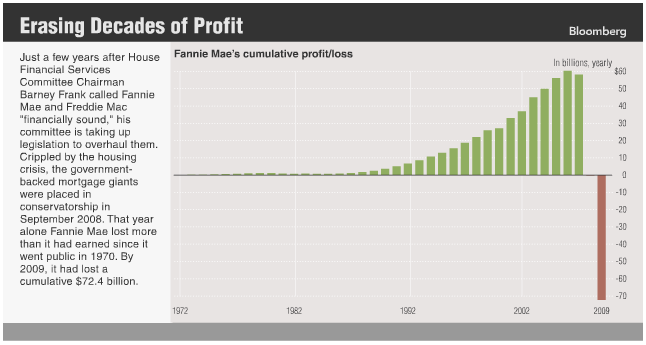

It really bothers me when people who should know better, want to bash people for things they can’t do. Congress is wholly to blame for the budget debacle that we have. They have not cut spending when they should and they still refuse to do so. Neither party has shown the courage to do the right thing. They both are equally bad, from a fiscal standpoint. They have and are continuing to ruin this country with their spending plans.

Regardless of the Republican bloodletting that the NY Times is eager to see, until and unless Congress cuts spending, this country has a serious problem. Hopefully both parties can wake up before we’ve become a third world country with no future.